Twilio and the New Economy

Twilio was founded on the idea that making software interoperate with telco networks is too hard. What if you could have a simple API to abstract away all the complexity of making phone calls and sending SMS? This notion has propelled the company into a tiny group of SaaS companies with over $1B in ARR. But voice and SMS usage are plateauing. And competitors with lower prices are popping up. So what's next for Twilio?

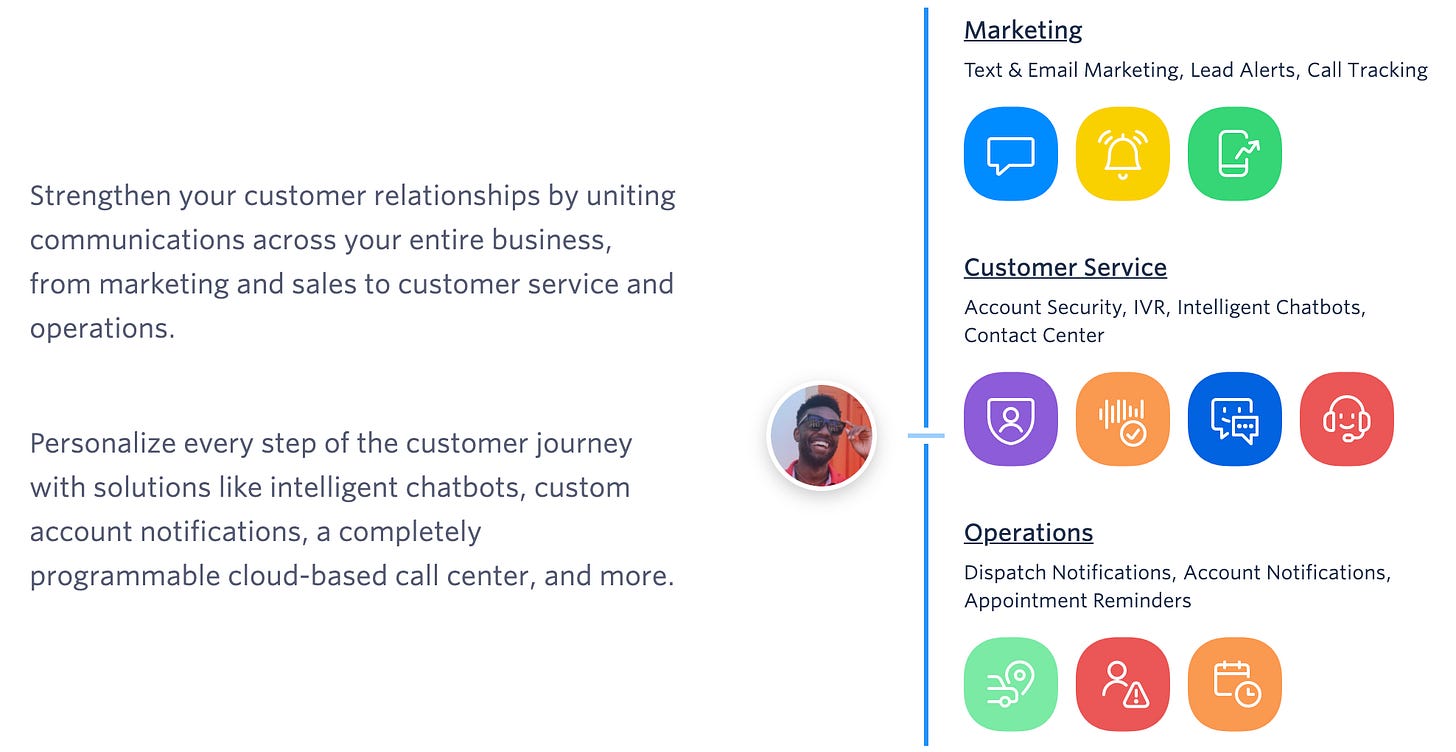

Twilio has started to show its ambition to expand from “APIs for telcos” to being the best and and most comprehensive customer communication platform for all digital products. The company's homepage reveals this if you compare how it positions its products between 2018 and today.

Homepage in 2018

Homepage in 2020

If they succeed, Twilio will be positioned to win the majority of one of the largest infrastructure segments of the new economy.

🏗 Investing in the infrastructure of the new economy

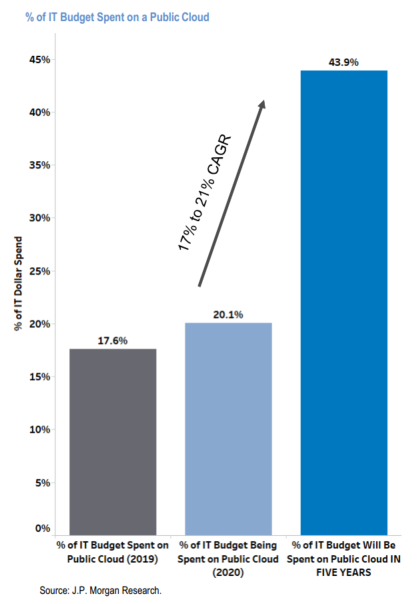

The “new economy” is an overloaded phrase that has been around for decades. Here, I’m using it to describe the phenomenon of every business in the world finding the need to have a digital product and digital distribution to stay relevant. Providing easy-to-use cloud infrastructure for this transition is one of the biggest markets there is. And while it feels like we’ve been talking about this for a decade, we are still in the early innings. According to JP Morgan, share of spending on cloud infrastructure is projected to more than double over the next five years. And even then it is expected to be at well under 50%.

One approach to thinking about this market is to consider the jobs that every business needs to accomplish. So what are these and how are they changing? Businesses need to...

Produce a product (manufacturing → cloud infra & tools)

Examples: AWS, Azure, DataDog, Snowflake

Market the product (print and broadcast → digital ads)

Examples: Facebook Ads, Google Ads

Distribute the product (brick and mortar → websites and apps)

Examples: Amazon 3rd Party, Shopify, Apple App Store

Receive payment (cash and credit cards → digital payment)

Examples: Stripe, PayPal, Square

Communicate with customers (in person → video, voice, and messages)

Examples: you guessed it, Twilio

Every example product above represents 10s of billions in market cap value - in some cases far more. The communications category appears to be among the least contested and Twilio is currently ahead by a mile. But it is still early. Twilio recently reached a $1.6B run rate - still less than 3% of management’s defined TAM.

⚡️ Lightning round on team, product, and defensibility

From here I’ll refer you to this post from Software Stack Investing, which also recommends Twilio. You'll find an excellent overview of the company's suite of products, developer-first growth strategy, and why the team & culture are positioned for long-term success. I recommend reading the whole thing. I’ll just layer on a bit of my own color commentary:

The Founder/CEO Jeff Lawson is technical, articulate, and has a low-salary + high-equity comp package. The COO and CMO are 10+ year Salesforce veterans (a company with undeniable GTM success)

Product team has a Bezos-inspired culture. Ideas like "Day One" and "Draw the owl" point to a company that is driven by builders

They have Jeff Immelt on the board. Uhh... didn't that dude run GE into the ground? 🤔

Their first products (programmable voice and sms) should be plateauing if you consider global traffic trends. Yet the company still grows 40%+ YoY. This is is a signal their expansion products are gaining traction

On the flip side, Twilio's gross margin hasn't moved much in the past three years. I expected some progress given all the new products

Scale in the early products is a meaningful moat because the Super Network is expensive and difficult to replicate. But long term success depends on Twilio’s ability to expand the product suite. Their huge developer community (reached 5M accounts in 2019) provides a great view on new opportunities

Once customers adopt, I expect very low churn. Twilio becomes an integral part of customers' products so switching costs are high. In addition, scale and brand makes Twilio the safe bet for their customers as long as they lead the market. A competing product would have to be 10x better for customers to switch

🕰 Returns depend on longevity

You could argue that all of SaaS is pretty expensive right now and Twilio is no exception (though it’s basically free if you compare to Snowflake 😂). Fortunately, getting solid returns doesn't depend on hyper growth but it does require that the company be able to sustain decent growth for a long time.

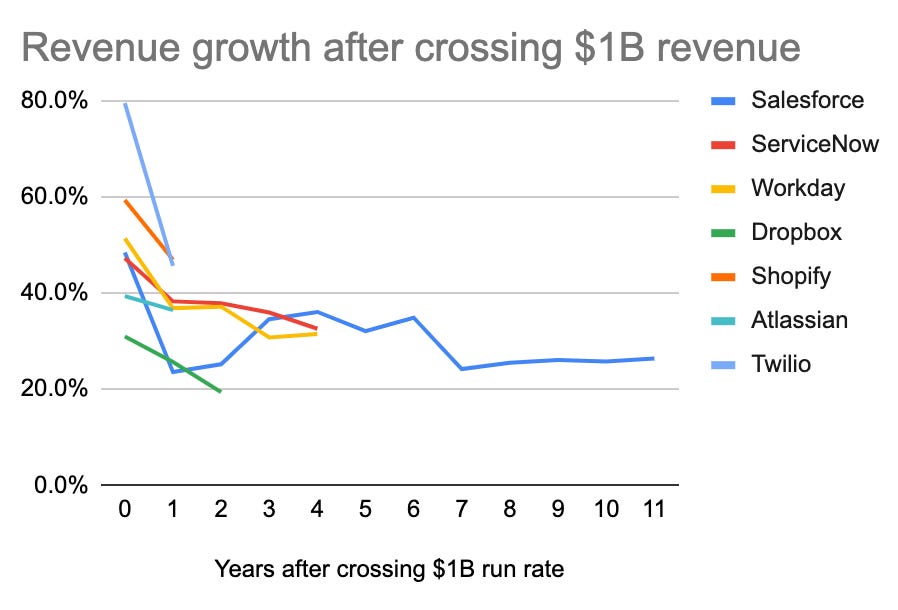

The list of public SaaS businesses with over $1B of revenue in 2019 is quite short: Salesforce ($13.3B), ServiceNow ($3.5B), Workday ($2.8B), Dropbox ($1.7B), Shopify ($1.6B), Atlassian ($1.2B), and Twilio ($1.1B). Of this impressive group, Twilio had the highest growth at the time of crossing the $1B revenue threshold. They're about tied with Shopify a year after crossing it.

If you believe Twilio can keep its growth above 30% for the next five years (it has fluctuated between 44% and 80% since IPO) they should be able to grow revenue to over $6B by 2025. If the price-to-sales multiple contracts to 10 by then (like Salesforce or Workday) then you're talking about a market cap of $60B+. Compared to the current valuation at $32B, this would be an IRR of about 15% - not a bad return on your money given we now live in the world of zero interest rates.

My bet is that Twilio can do it but it will require that they succeed at expanding beyond the voice and SMS products that got them to where they are today. They have a lot of things going for them: low churn, great market, a leading position, and a proven team. They can expand their existing customers at 20-30% for years (32% in the most recent quarter). They can add new customers at 10-20% for years (23% in the most recent quarter). And on top of that they'll expand to new use cases and acquire companies. I think patient investors in Twilio will be rewarded with ownership in one of the most essential infrastructure companies of the 2020s.

Next Thesis is long Twilio with an average cost basis of $242.71 as of publishing. Assume the usual disclaimers. Do your own research before investing.